School finance is a complicated subject. One key concept is the fund balance—the financial cushion that helps school districts manage expenses and avoid borrowing. The fund balance is not simply a rainy-day fund. We’d like to share information about this concept to clarify why spending down the fund balance is not the answer to our budget shortfall.

What is a Fund Balance?

A fund balance is the difference between a district’s assets (such as cash and investments) and liabilities (such as outstanding expenses). Wisconsin school districts receive property tax and state aid payments at different times throughout the year, which causes significant fluctuations in cash flow. Without an adequate fund balance, the district would need to borrow short-term cash to pay bills and meet payroll. Given the high interest rates currently in effect, this would further eat into the district’s budget.

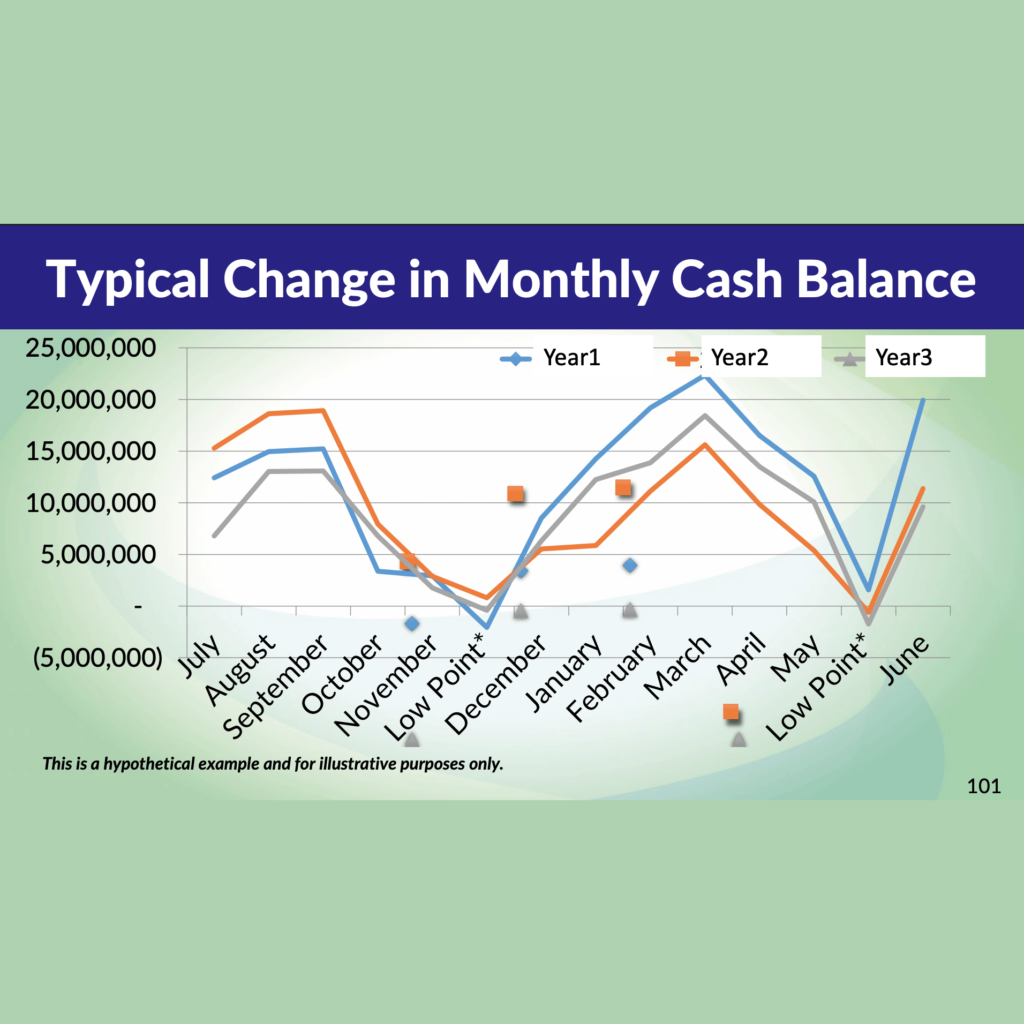

These reserves cover unexpected costs and stabilize cash flow because funding is not consistently received throughout the year. The example below from the Wisconsin Association for School Business Officials illustrates how revenues and expenses fluctuate throughout the fiscal year.

These one-time funds should not be used for ongoing operational expenses, such as staff raises, that create a long-term budget obligation. Once fund reserves are spent, rebuilding them can be difficult.

Key Facts About Fund Balances:

- A healthy fund balance is often between 20% and 25% of a district’s annual expenditures or two to three months of general fund expenses.

- Fund balance levels vary by district, but the main goal is to avoid short-term borrowing.

- Fund balances fluctuate daily but are officially reported as of June 30 each year.

- KUSD’s unassigned fund balance as of 6/30/2024 was 23.7%.

- While cash is an asset, a fund balance is not the same as cash—it includes other financial elements.

Why is a Fund Balance Important?

A sufficient fund balance helps a district:

- Avoid short-term borrowing and interest costs

- Maintain financial stability

- Generate revenue during periods of high interest rates through investing

- Protect academic programs and student opportunities during times of uncertainty

Maintaining a responsible fund balance is essential to ensuring sustained investment in student success. For more information on KUSD’s budget, visit kusd.edu/budget. For more information on fund balance guidelines, visit the Government Finance Officer Association (GFOA) webpage.